To: R-CALF USA Members & Affiliates

From: Bill Bullard, CEO

Date: July 1, 2020

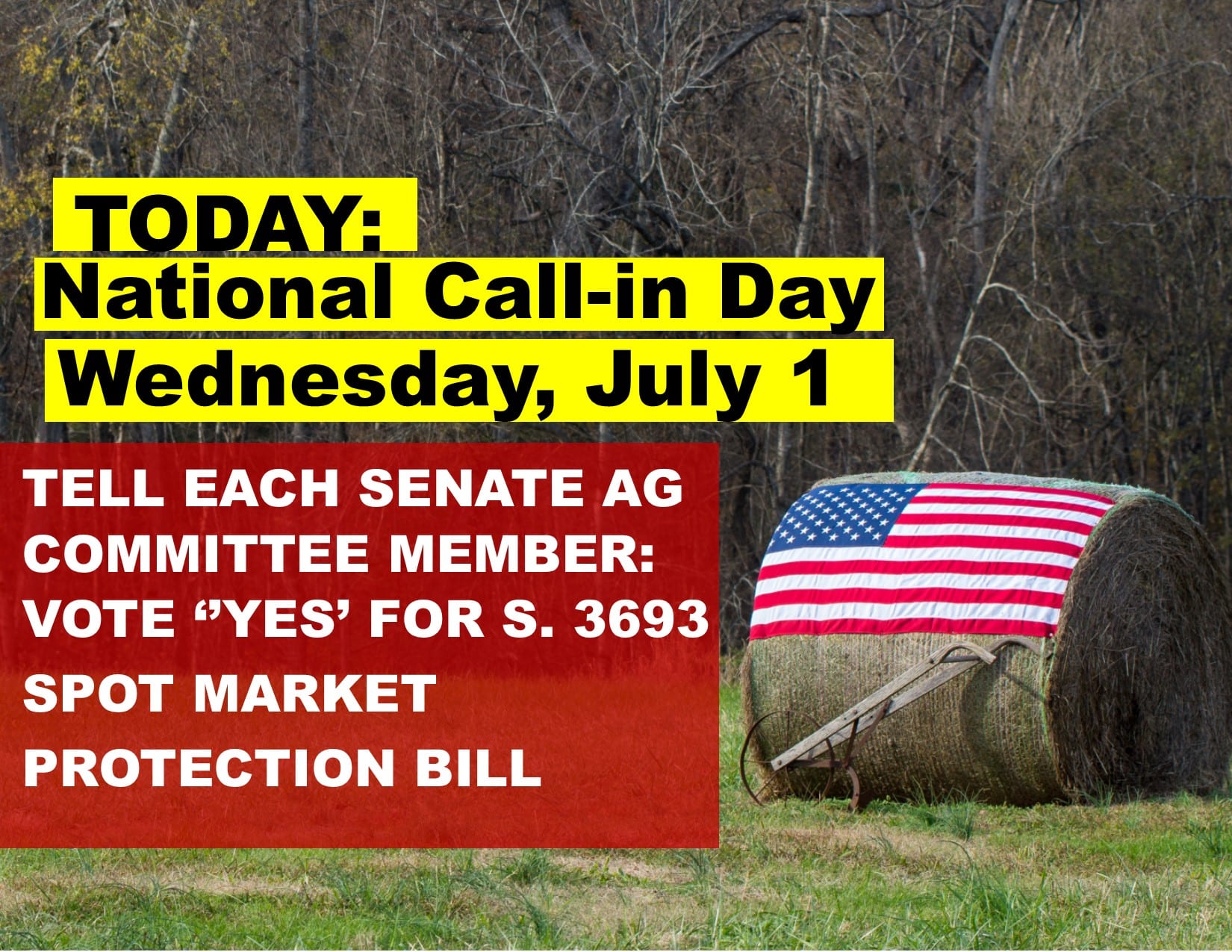

Subject: National Call-in Day for Grassley/Tester Bill TODAY, Wed., July 1

Background: The Grassley/Tester Bill, S.3693 will help restore and preserve the integrity of our industry’s most important market – the fed cattle spot (cash) market where fat cattle are sold directly to the packer.

Senate Bill 3693 was introduced on May 12. It requires the largest packers (those with multiple plants) to purchase at least 50% of their daily cattle needs for each plant from the competitive spot market and to kill those cattle within 14 days (so they can’t be converted to captive supplies).

This is exactly what R-CALF USA asked Congress to do as part of our triage recommendations previously sent to the President and to Congress.

Now, we must get S.3693 passed in Congress!

The Bill must first pass the U.S. Senate Agriculture Committee. There are 20 Senators on the Ag Committee. We want it to pass by a wide margin, at least by 80 percent. That means we need 16 “Yes” votes.

We already have 4 of those votes because the following Senate Ag Committee members are sponsors of S.3693:

Senator Charles Grassley, R-Iowa

Senator Joni Ernst, R-Iowa

Senator Cindy Hyde-Smith, R-Mississippi

Senator Tina Smith, D-Minnesota

We need 14 more “Yes” votes.

Action: TODAY, Wednesday, July 1 we must generate thousands of calls to each and every member of the Senate Agriculture Committee.

Using the list (click below), please begin calling each member of the Senate Ag Committee and tell them that S.3693 is absolutely critical for fixing our severely broken fed cattle spot (cash) market.

Here is a suggested message:

“Hello, I’m __[Your Name]__ and I’m a rancher (or cattleman or woman) from __[Your town and State]__. As you know, our cattle market is seriously broken and the first step to fix it is to vote “Yes” to pass S.3693, the Grassley/Tester bill out of the Senate Ag Committee. Please tell Senator Grassley that you support S.3693. This is extremely important as the viability of the entire U.S. cattle industry is at stake. Please support America’s cattlemen and women by supporting S.3693.”

Farther below is a Factsheet for S.3693. If the Senators you call ask you for more information, please share this Factsheet with them.

Remember, we need to flood each Senate Agriculture Committee member’s office with thousands of calls on Wednesday, July 1.

Please make your calls to each of these members! This is vital!

Members of Senate Agriculture Committee (2020)

Pat Roberts, Kansas, Chairman: 202-224-4774

Mitch McConnell, Kentucky: 202-224-2541

John Boozman, Arkansas: 202-224-4843

John Hoeven, North Dakota: 202-224-2551

Joni Ernst, Iowa: 202-224-3254 Already a sponsor. Thank her.

Cindy Hyde-Smith, Mississippi: 202-224-5054 Already a sponsor. Thank her.

Mike Braun, Indiana: 202-224-4814

Kelly Loeffler, Georgia: 202-224-3643

Chuck Grassley, Iowa: 202-224-3744 Already a sponsor. Thank him.

John Thune, South Dakota: 202-224-2321

Deb Fischer, Nebraska: 202-224-6551

Debbie Stabenow, Michigan: 202-224-4822

Patrick Leahy, Vermont: 202-224-4242

Sherrod Brown, Ohio: 202-224-2315

Amy Klobuchar, Minnesota: 202-224-3244

Michael Bennet, Colorado: 202-224-5852

Kirsten Gillibrand, New York: 202-224-4451

Bob Casey, Pennsylvania: 202-224-6324

Tina Smith, Minnesota: 202-224-5641 Already a sponsor. Thank her.

Dick Durbin, Illinois: 202-224-2152

Be sure to thank the 4 members who are already sponsors!

Please share this National Call-in Day Alert far and wide!

Thank you for your support!

We’ll be in touch. Below is the Factsheet:

S.3693 Fact Sheet

Spot Market Protection Bill

Prepared by R-CALF USA

Updated June 26, 2020

Background and History:

The fed cattle cash or spot market is the holy grail for the entire U.S. live cattle industry. Not only is this where price discovery occurs for all fed cattle ready for slaughter, but the price discovered in the spot market translates into prices for all cattle throughout the live cattle supply chain, regardless of age or weight.

Therefore, the health and viability of the entire U.S. cattle industry – generating over $67 billion in annual cash receipts, making it the largest sector of American agriculture[1] – is absolutely dependent upon a robustly competitive and transparent spot market.

From the 80s through the 90s beef packing concentration and consolidation substantially reduced marketing outlets for fed cattle, both in terms of the number of packing companies and the number of packing plants. Today, only four major beef packing companies control approximately 85% of the fed cattle market and operate only about 24 packing pants.[2]

Prior to the early- to mid-2000s, packers purchased the majority of their fed cattle needs from cattle feeders in the spot market. Thus, the price discovery market comprised the majority of all cattle sold. The 2007 GIPSA Livestock and Meat Marketing Study found that the use of alternative marketing arrangements is associated with lower cash market prices,[3] and that the average cattle price from the combination of spot market sales (both auction and direct trade sales) at $132.32 per cwt is higher than the $130.07 per cwt average cattle price generated from the combination of alternative marketing arrangements (forward contracts, marketing agreements, packer-owned, and other purchase methods).[4]

Since the mid-2000s, and due to the highly concentrated fed cattle markets, independent cattle feeders are increasingly subjected to market access risk, meaning risk of not being able to timely access the market when their cattle were ready for slaughter. Studies show this market access risk is the reason cattle feeders are willing to forego higher prices received in the cash market in exchange for guarantees of timely market access through some form of alternative marketing arrangement.[5]

In 2005 about 52% of all fed cattle were still purchased in the spot market.[6] But after 2005, the packers increasingly shifted larger and larger volumes of cattle out of the spot market and into their alternative marketing arrangements. By 2015, the volume in the spot market had fallen below 22% nationally, and below 3% in the Texas-Oklahoma-New Mexico region.[7]

Industry-wide concerns over the ultra-thin spot market have proven ineffective in restoring robustness to the spot market as evidenced by a meager 4% increase in the spot market volume from 2015 through 2018.[8]

Although some economists disagree – those who have long supported the considerable concentration of the U.S. fed cattle market, economic studies do show that cattle prices are negatively impacted when packers procure more of their cattle through alternative marketing arrangements than from the spot market. For example, in a 2011 study, economists Andrew Lee and Man-Keun Kim found that beginning with only about 20% of procurement outside the spot market (meaning when the spot market volume is as high as 80%) fed cattle prices are negatively impacted.[9]

This study reinforced work by Tian Xia and Richard Sexton,[10] which in 2009 was cited by economist Steven Koontz and described as a finding that if packers secure 50% or more of their needed cattle supplies through means other than the spot market, then the fed cattle market price can be depressed to the monopsony level and maximum market power exerted.[11]

The Spot Market Protection Bill:

Senator Charles Grassley (R-IA), along with Senators Jon Tester (D-MT), Joni Ernst (R-IA), Cindy Hyde Smith (R-MS), Mike Rounds (R-SD), Tina Smith (D-MN), and Steve Daines (R-MT), introduced S. 3693, the spot market protection bill, in Congress on May 12, 2020.

Senate Bill S.3693 reverses the considerable volume erosion that has occurred in the spot market since the mid-2000s by requiring large packers with multiple plants to purchase at least 50% of their daily cattle procurement needs for each of their plants from the spot market, and to harvest those cattle within 14 days of purchase.

Senate Bill S.3693, therefore, restores the volume in the spot market to a minimum level – below which studies have found harm to cattle prices – necessary to preserve the competitive spot market for all cattle feeders and to protect the attendant price discovery function of the spot market for all of the U.S. cattle industry’s cattle producers, both feeders and non-feeders.

Senate Bill S.3693 is an amendment to the Livestock Mandatory Reporting Act of 1999, which is to be reauthorized by September 30, 2020.

# # #

R-CALF USA (Ranchers-Cattlemen Action Legal Fund, United Stockgrowers of America) is the largest producer-only lobbying and trade association representing U.S. cattle producers. It is a national, nonprofit organization dedicated to ensuring the continued profitability and viability of the U.S. cattle industry. Visit www.r-calfusa.com or, call 406-252-2516 for more information.

[1] See USDA Economic Research Service, Cash Receipts by Commodity, 2011-2020F, Nominal (current dollars), available at https://data.ers.usda.gov/reports.aspx?ID=17845.

[2] See, e.g., Top 30 Beef Packers 2013, The Market Works (citing Cattle Buyer’s Weekly as its source), available at http://www.themarketworks.org/sites/default/files/uploads/charts/Top-30-Beef-Packers-2013.pdf.

[3] GIPSA Livestock and Meat Marketing Study, Volume 3, Fed Cattle and Beef Industries, at ES-2; 7-10, available at https://www.gipsa.usda.gov/psp/publication/livemarketstudy/LMMS_Vol_3.pdf.

[4] See Id., Table 5-1, at 5-8.

[5] See Mingxia Zhang & Richard J. Sexton, Captive Supplies and the Cash Market Price: A

Spatial Markets Approach, 25 J. Agriculture and Resource econ., (2000), at 97, available at

https://www.r-calfusa.com/industry_info/2008_JBS_merger/080409-Exhibit6_ZhangandSexton2000.pdf. See also supra, Note 2, at 2-36.

[6] See Livestock Mandatory Reporting Purchase Type Breakdown by Region, USDA-Agricultural Marketing Service, Livestock, Poultry and Grain Market News, 2005-2018.

[7] Id.

[8] Id.

[9] See Captive Supply Impact on the U.S. Fed Cattle Price: An Application of Nonparametric Analysis, Andrew C. Lee and Man-Keun Kim, Journal of Rural Development 34(4): 103-115.

[10] The Competitive Implications of Top-of-the-Market and Related Contract-Pricing Clauses, Tian Xia and Richard J. Sexton, Amer. J. Agr. Econ. 86(1) (February 2004), at 124-138.

[11] Comments Regarding Agriculture and Antitrust Enforcement Issues in Our 21st Century Economy, Stephen R. Koontz (December 2009), at 9 (citing the work of Xia and Sexton).