Billings, Mont. – On Monday, R-CALF USA asked the Commodity Futures Trading Commission (CFTC) to investigate packer trading activities on specific dates spanning the past six years. The group states it identified numerous anomalies in the cattle futures market and suspects packers were making trades in the futures market to drive cash cattle prices downward.

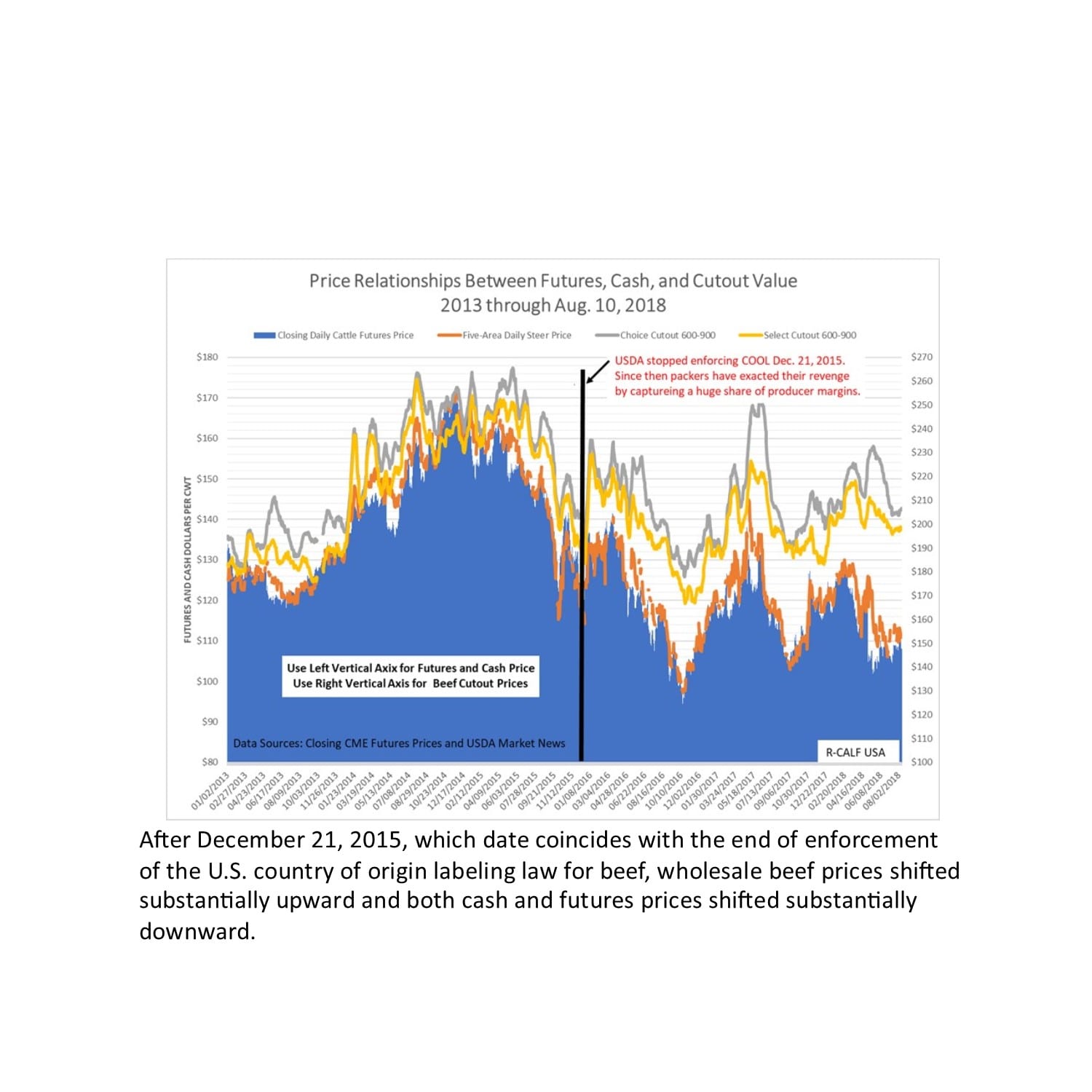

The request includes charts for each of the years 2013-2018, depicting price relationships between cattle futures prices, cash fed cattle prices received by producers, and wholesale prices received by packers. In another chart, all the years’ data were combined in a single chart.

“Our members asked us to make this request after the unexplainable drop in the futures market that occurred earlier this year. As wholesale prices were strengthening, and cash fed cattle prices were chasing them upwards, an inexplicable break in the futures market caused those prices to collapse,” said R-CALF USA CEO Bill Bullard.

The group’s research shows several breaks in the futures market during each of the years it analyzed. R-CALF USA calls those breaks anomalies because they occurred when cash fed prices were trending upward in response to higher wholesale beef prices.

The request states, “We request an investigation to determine if the packers, or a person or fund representing the packers’ interests, were responsible for the trades that drove the futures market downward” on each of the specific dates the group identified as anomalous futures market trades.

The group speculates that the anomalous trades that occurred in 2013 and 2014, while cattle prices were rallying, were attempts to stop the price rally but were ineffective because cattle supplies were very tight and the packers were forced to compete for available supplies.

However, the group states in 2015 and beyond, when cattle supplies increased, those same anomalous trades reaped huge financial rewards for the packers because with more plentiful supplies, the packers shifted from competing against each other to cooperating with each other to drive cattle prices lower.

The group states its combination chart for all years analyzed reveals a fundamental shift in the U.S. cattle market, which now allows packers to earn windfall profits.

Bullard stated the multi-year chart reveals that after December 21, 2015, which date coincides with the end of enforcement of the U.S. country of origin labeling law for beef, wholesale beef prices shifted substantially upward and both cash and futures prices shifted substantially downward.

“In other words, after December 21, packers began capturing the largest gross margins in history while cattle producers continued receiving depressed prices for their cattle. This explains why packer margins are now well over $300 per head.

“This is alarming and clear evidence our marketplace is broken. We hope the CFTC can uncover who is to blame for our dysfunctional markets,” concluded Bullard.

R-CALF USA (Ranchers-Cattlemen Action Legal Fund, United Stockgrowers of America) is the largest producer-only cattle trade association in the United States. It is a national, nonprofit organization dedicated to ensuring the continued profitability and viability of the U.S. cattle industry. For more information, visit www.r-calfusa.com or call 406-252-2516.