To: R-CALF USA Members and Affiliates

From: CEO Bill Bullard

Date: April 23, 2020

Background: The most important market for the entire live cattle supply chain is the industry’s fed cattle cash market. Whatever price is determined there translates to prices for calves and yearlings. Thus, any distortion that occurs there impacts the entire live cattle supply chain. Also, because the cash market informs the futures market, it is vital to predicting futures prices.

In January the cash market conveyed a price of about $1,610 for a 1,300 lb. fed steer. Today the cash market price is trading at or below $1,300 – a loss of $310 per steer, well below the cost of production.

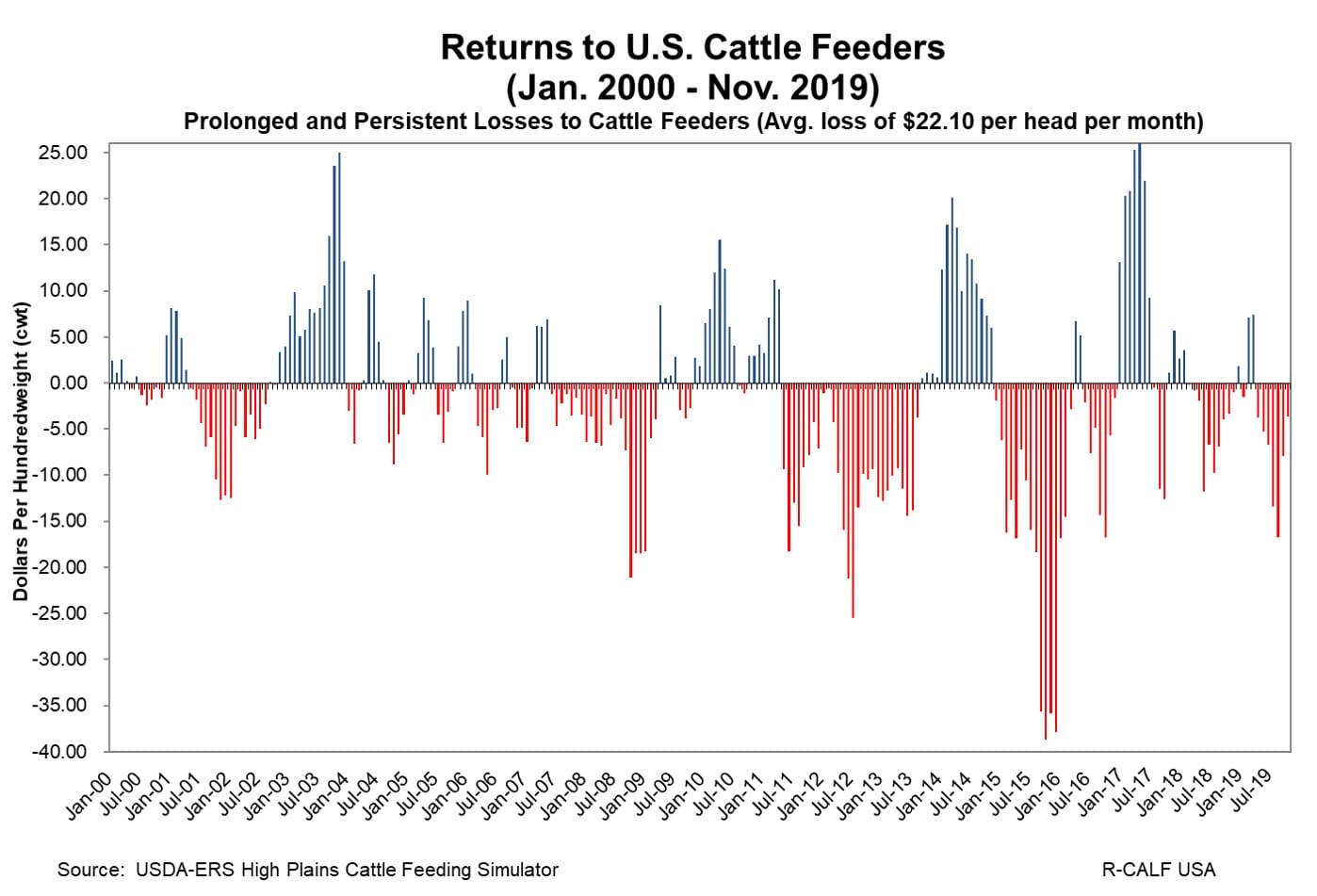

But, conveying prices that are below the cost of production have been the norm for the cash market for many years. R-CALF USA’s chart titled Returns to U.S. Cattle Feeders compiles USDA data that show the average return to cattle feeders during the past 19 years was a negative $22 per head per month for the past 19 years. These negative returns were estimated based on the price conveyed in the cash market for each of those months.

Things are very different now. Today while the cash market conveys extremely low prices, wholesale beef prices are skyrocketing and everyone knows it. Beef cutout values today are at $270.99 for Choice beef. They were at $206.69 in mid-February.

This manifest imbalance: falling cattle prices and rising wholesale (and retail) prices, is causing every cattle producer to take a critical look at their cattle markets, many for the first time in in their lifetimes.

How bad will it get?

The four largest packers have about 24 physical plants. They kill about 85% of the cattle fed by the 2,160 larger-than-1,000-head feedlots and the 26,000 remaining less-than-1,000-head feedlots. COVID-19 has caused packers to slow production, and in some cases to temporarily cease operations (e.g., the JBS plant in Greeley, Co.).

This is causing a disastrous chain reaction: Packers are reducing kills which means feedlots cannot market their cattle (some feeders have told us they have not had a bid for their fed cattle for four weeks). This is causing feedlots to back up and to stop buying feeder cattle.

Yesterday morning the CME Group reported estimates by analysts who believe placements of cattle in feedlots in March may be down 18% from the same time last year. And, it reported that auction yard sales of feeder cattle in March were down an alarming 53% compared to the same time last year.

So, cattle are bottlenecking throughout our live cattle supply chain, and it’s happening when beef demand and beef prices are continuing to rise.

Importers are now exploiting the U.S. cattle producers’ dilemma. Combined beef and cattle imports jumped 22 percent from mid-March to early April. These imports are displacing U.S. cattle producers’ access to their own market. They will continue to do so until Congress restores Mandatory Country-of-Origin Labeling (MCOOL) for beef.

This said, we simply do not know how bad this will get. Some industry commenters are predicting the packer bottleneck could continue for another two to four weeks. We have no better information to say otherwise.

What Should Our Industry Do?

The one thing the President and Congress can do immediately in the midst of this crisis is to give you the ability to compete against the rising volumes of cheaper, undifferentiated imports by immediately reinstating MCOOL for beef.

Also, the volume of fed cattle sold in the cash market last week was razor thin – just over 7%, and the cash market conveyed a seriously depressed fed cattle price of only $102.26 cwt. Economists conducted research showing if packers can secure 50% or more of their cattle through captive supplies, the fed cattle market price can be depressed to the monopsony level and maximum market power exerted. Other economists later found there was “clearly more market power being exercised in fed cattle markets” in the 10-year period after 2001 than in prior years. Based on these and other studies, as well as R-CALF USA’s own research showing the average weekly cash volume was nearly 47% during the 10-year period in which a clear increase in the exercise of market power was found, any floor for a cash market volume below 50% would not likely rebalance the negotiating power between cattle sellers and packers. So, if Congress were to immediately raise the cash volume floor to at least 50%, this would increase the bargaining power of cattle feeders. In the midst of this crisis this would allow more cattle feeders to access the bottlenecked market. This would be a positive.

These are the two emergency market structural reforms we and our members have been urging Congress to pass as quickly as possible:

- Require all beef sold in America to be labeled as to where the animal was born, raised and slaughtered.

- Require packers to purchase a majority of their cattle from the fast-shrinking fed cattle cash market.

Please continue calling on your members of Congress to enact these two important reforms.

And then what?

Today is the one-year anniversary of the historic lawsuit R-CALF USA and four cattle feeders filed months before the August Tyson fire and almost a year before this COVID-19 crisis. Our lawsuit alleges that since January 1, 2015 the Big 4 beef packers conspired to artificially depress fed cattle prices through various means, including:

- collectively reducing their slaughter volumes and purchases of cattle sold on the cash market in order to create a glut of slaughter-weight fed cattle;

- manipulating the cash cattle trade to reduce price competition amongst themselves, including by enforcing an antiquated queuing convention through threats of boycott and agreeing to conduct substantially all their weekly cash market purchases during a narrow 30-minute window on Fridays;

- transporting cattle over uneconomically long distances, including from Canada and Mexico, in order to depress U.S. fed cattle prices; and

- closing slaughter plants to ensure the underutilization of available U.S. beef packing capacity.

One of the first major hearings in this case will be held on June 8, 2020.

So, R-CALF USA and its members already have the “And then what?” well underway. This one is in our third branch of government – the U.S. judicial system. In future alerts we will describe the comprehensive market reforms we continue asking Congress to pass.

Our goal is clear: We are fighting to restore every U.S. cattle producers’ opportunity to continue operating as independent producers by earning a fair and competitive income in a robustly competitive marketplace.

Thank you for your support and we’ll be in touch.

# # #

R-CALF USA (Ranchers-Cattlemen Action Legal Fund, United Stockgrowers of America) is the largest producer-only lobbying and trade association representing U.S. cattle producers. It is a national, nonprofit organization dedicated to ensuring the continued profitability and viability of the U.S. cattle industry. Visit www.r-calfusa.com or, call 406-252-2516 for more information.